Microbial Identification Market by Product & Service (Instrument & Software, Consumable, Service), Method (Phenotypic, Proteomic), Technology (Mass Spectrometry, PCR), Application (Diagnostic, Food Testing), End User (Hospital) & Region - Global Forecast to 2025

Market Growth Outlook Summary

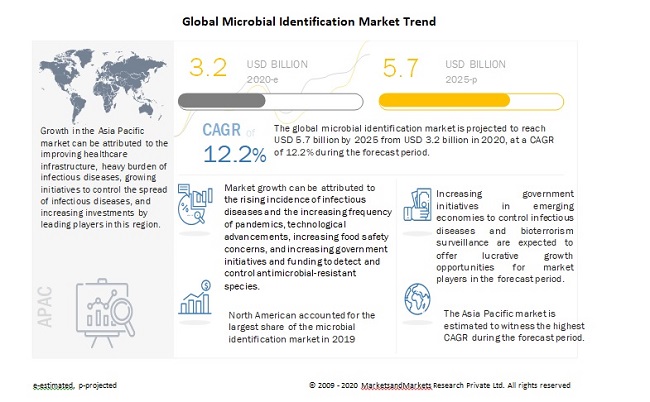

The global microbial identification market growth forecasted to transform from $3.2 billion in 2020 to $5.7 billion by 2025, driven by a CAGR of 12.2%. Growth in this market is largely driven by the rising incidence of infectious diseases and the increasing frequency of pandemics, technological advancements, increasing food safety concerns, and increasing government initiatives and funding to detect and control antimicrobial-resistant species.

To know about the assumptions considered for the study, Request for Free Sample Report

Microbial Identification Market Dynamics

Driver: Rising incidence of infectious diseases and increasing frequency of pandemics

Microbial identification is mainly used for human disease diagnosis. It delivers rapid and reliable results that help in the timely adoption of appropriate therapies. Microbial identification products can improve the management of infectious diseases, especially in areas with inadequate healthcare infrastructure. It is estimated that approximately 1,400 pathogens can cause human diseases. Pathogenic bacteria alone cause about 350 million cases of foodborne diseases. About 48 million foodborne illnesses occur annually in the US alone, which leads to approximately 128,000 hospitalizations and 3,000 deaths every year. Poor water hygiene can cause 1.7 million deaths a year worldwide, and 9 out of 10 deaths occur in children. Most of these deaths, however, are observed in developing countries (NCBI).

Over the years, there has been a significant increase in the prevalence of infectious diseases worldwide. According to the WHO, TB is one of the top 10 causes of death. A total of 1.5 million people died from TB in 2018 worldwide. Between 2000–2018, an estimated 58 million lives were saved through TB diagnosis and treatment. ccording to the Joint United Nations Programme on HIV/AIDS (UNAIDS), in 2019, globally, 1.7 million people were newly infected with HIV, 38 million people are living with HIV, and 690,000 people died of AIDS-related illnesses.

Furthermore, incidents such as the Zika epidemic (2016), Ebola epidemic (2014), H1N1 swine flu pandemic (2009), H5N1 Avian flu pandemic (2004), Severe Acute Respiratory Syndrome (SARS) pandemic (2003), and Severe Acute Respiratory Syndrome Coronavirus 2 (SARS-CoV-2) pandemic (2019–2020) have caused serious health concerns. They also lead to an increased demand for diagnostic products, including those for microbial identification. Thus, the high prevalence and incidence of different infectious diseases, coupled with the increasing frequency of pandemics, are driving growth in the global market.

Restraint: High cost of automated microbial identification systems

Automated microbial identification instruments are equipped with highly advanced features and functionalities and are priced at a premium. The price for a MALDI-TOF-based system varies from USD 150,000 to USD 850,000. The consumables used for identification techniques are also expensive, and there is an added labor cost. Many of the new rapid tests typically range from USD 100–USD 250; they cost significantly more than the conventional culture methods. The estimated cost for instruments, media, and labor is excessively high for some end users.

Automated microbial identification systems are priced within the range of USD 50,000 to USD 75,000. Pharmaceutical companies require many such systems and, hence, the capital cost increases significantly. Academic research laboratories generally cannot afford such systems as they have limited budgets. In addition, the maintenance costs and several other indirect expenses result in an overall increase in the total cost of ownership of these instruments. This hinders the mass adoption of automated microbial identification systems, especially by relatively small institutions.

Opportunity: Emerging economies present significant growth opportunities

The emerging economies are expected to become a focal point for the growth of the microbial identification market. The Asia Pacific, Middle Eastern, and Latin American regions are relatively untapped markets for microbial identification companies compared to Europe and North America. Owing to this, governments in various Asian countries are supporting the development of the global market. In this regard, several initiatives have been started by global organizations in Asia:

- In 2020, the Australian Government released Australia’s next national antimicrobial resistance strategy, following an endorsement by the Council of Australian Governments. Australia’s National Antimicrobial Resistance Strategy - 2020 and beyond sets a 20-year vision to protect the health of humans, animals, and the environment by minimizing the development and spread of AMR while continuing to have effective antimicrobials available.

- In 2019, Thermo Fisher Scientific (US) opened a food safety customer solution center in Delhi, India. The new center focuses on meeting the demands of scientists in food & beverage laboratories by developing critical workflows and integrated solutions that help build the food safety capacity in India.

- In 2017, the Ministry of Health and Family Welfare, Government of India, launched the National Strategic Plan (NSP) for Tuberculosis (TB) Elimination (2017–2025), a statement of commitment to eliminating TB by 2025. The strategy proposes bold strategies and resources to rapidly decline TB incidence and mortality in India by 2025.

- In recent years, China has joined the global AMR efforts by implementing a series of national strategies to address AMR, including its National Action Plan (NAP) to Contain Antimicrobial Resistance (2016–2020). The NAP has identified funding sources; a monitoring and evaluation process is in place, and the plan is currently being implemented.

Such initiatives by various governments in these economies provide an array of opportunities for players in the market to invest in the emerging regions.

Challenge: Complex regulatory frameworks that delay the approval of new microbial diagnostic tests

The current FDA approval process for instruments and consumables is very lengthy and complex. In May 2016, the Council of the European Union issued the new In Vitro Diagnostic Device Regulation (IVDR), which replaced the existing In Vitro Diagnostic Devices Directive (IVDD) 98/79/EC. IVDR was enforced in 2017 by the European council. The new rules will apply, starting May 2022, for IVDR. Companies will have five years to comply with the new regulations. These are more complex and stricter regulations. Market players will, therefore, find it challenging to align their processes with the new regulations, which could temporarily impact the time to market for new products, especially in the US and Europe.

By the consumables segment, the panels/ID cards & media segment accounted for the largest share of the microbial identification industry in 2019.

On the basis of product & service type, the microbial identification market is segmented into panels/ID cards & media, kits and other consumables. In 2019, panels/ID cards & media accounted for the largest share of the consumables segment. Panels, ID cards, and media enable the easy and rapid identification of microorganisms and is a key factors driving market growth

By technology, the mass spectrometry segment accounted for the largest share of the microbial identification industry in 2019.

On the basis of technology, the microbial identification market is categorized into five technology segments— mass spectrometry, PCR, flow cytometry, microscopy, and other microbial identification technologies.

The mass spectrometry segment accounted for the largest share in 2019, due to its high speed, high specificity, and applicability for a wide range of microorganisms such as bacteria, archaea, and fungi. The rising adoption of MALDI-TOF technology for microbial identification is another major factor supporting market growth.

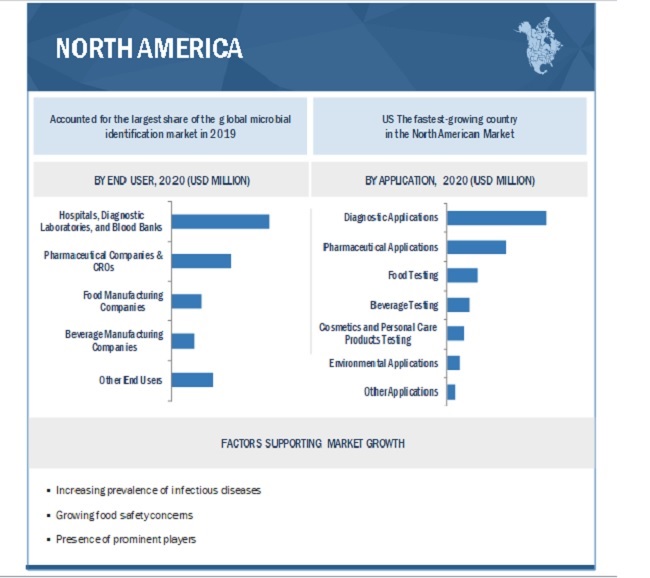

By end user, hospitals, diagnostic laboratories, and blood banks segment accounted for the largest share of the microbial identification industry in 2019.

On the basis of end user, the microbial identification market has been segmented into hospitals, diagnostic laboratories, and blood banks; pharmaceutical companies & CROs; food manufacturing companies; beverage manufacturing companies; and other end users.

The hospitals, diagnostic laboratories, and blood banks segment dominated the global market in 2019, due to the high prevalence of different infectious diseases, coupled with periodic outbreaks of pandemics.

North America accounted for the largest share of the microbial identification industry in 2019.

In 2019, North America accounted for the largest share of the overall microbial identification market, followed by Europe. Technological advancements in microbial identification, increasing prevalence of infectious diseases, growing food safety concerns, and the presence of prominent players are the major drivers of the North American market.

To know about the assumptions considered for the study, download the pdf brochure

The microbial identification market is dominated by a few globally established players such as bioMérieux SA (France), Becton, Dickinson and Company (US), Thermo Fisher Scientific Inc. (US), Danaher Corporation (US), Merck KGaA (Germany), Bruker Corporation (US), Shimadzu Corporation (Japan), QIAGEN NV (Netherlands), Avantor, Inc. (US), and Biolog, Inc. (US)

Scope of the Microbial Identification Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2020 |

$3.2 billion |

|

Projected Revenue Size by 2025 |

$5.7 billion |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 12.2% |

|

Market Driver |

Rising incidence of infectious diseases and increasing frequency of pandemics |

|

Market Opportunity |

Emerging economies present significant growth opportunities |

The study categorizes the microbial identification market to forecast revenue and analyze trends in each of the following submarkets:

By Product & Service

- Instruments & Software

-

Consumables

- Panels/ID Cards & Media

- Kits

- Other Consumables

- Services

- Microbial identification Market, by Method

- Phenotypic Method

- Proteomic-based Method

- Genotypic Method

By Technology

- Mass Spectrometry

- PCR

- Flow Cytometry

- Microscopy

- Other Microbial Identification Technologies

By Application

- Diagnostic Applications,

- Pharmaceutical Applications

- Food Testing

- Beverage Testing

- Cosmetics and Personal Care Products Testing

- Environmental Applications

- Other Applications

By End User

- Hospitals, Diagnostic Laboratories, and Blood Banks

- Pharmaceutical Companies & CROs

- Food Manufacturing Companies

- Beverage Manufacturing Companies

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- South Korea

- Rest of Asia Pacific

-

Rest of the World

-

Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

-

Latin America

Recent Developments of Microbial Identification Industry:

- In 2019, bioMérieux acquired Invisible Sentinel (US) to strengthen its food pathogen testing and spoilage organism detection capabilities by expanding its business into new customer segments, such as breweries and wineries.

- In 2019, Thermo Fisher Scientific (US) opened a food safety customer solution center in Delhi, India. The new center focuses on meeting the demands of scientists in food and beverage laboratories by developing critical workflows and integrated solutions that help build the food safety capacity in India.

- In 2019, Merck (Germany) partnered with the FSSAI for skill development in food safety. Under the terms of this partnership, Merck handed over a fully equipped microbiological testing laboratory to the FSSAI to provide training on the latest technologies in microbiological testing for food safety.

Frequently Asked Questions (FAQs):

What is the projected market value of the global microbial identification market?

The global market of microbial identification is projected to reach USD 5.7 billion.

What is the estimated growth rate (CAGR) of the global microbial identification market for the next five years?

The global microbial identification market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.2% from 2020 to 2025.

What are the major revenue pockets in the microbial identification market currently?

North America accounted for the largest share of the overall market, followed by Europe. Technological advancements in microbial identification, increasing prevalence of infectious diseases, growing food safety concerns, and the presence of prominent players are the major drivers of the North American market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 37)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 42)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.2 MARKET DATA ESTIMATION & TRIANGULATION

2.2.1 DATA TRIANGULATION

FIGURE 1 DATA TRIANGULATION METHODOLOGY

2.3 MARKET ESTIMATION METHODOLOGY

FIGURE 2 MARKET SIZE ESTIMATION: APPROACH 1 (COMPANY REVENUE ANALYSIS-BASED ESTIMATION

FIGURE 3 GLOBAL MARKET SIZE (USD BILLION

FIGURE 4 GLOBAL MARKET: FINAL CAGR PROJECTIONS (2020?2025

FIGURE 5 GLOBAL MARKET: CAGR PROJECTIONS FROM THE ANALYSIS OF DEMAND-SIDE DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

FIGURE 6 GLOBAL MARKET: SEGMENTAL ASSESSMENT

2.4 INDUSTRY INSIGHTS

2.5 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 49)

FIGURE 7 MICROBIAL IDENTIFICATION MARKET, BY PRODUCT & SERVICE, 2020 VS. 2025 (USD MILLION)

FIGURE 8 GLOBAL MARKET SHARE, BY METHOD, 2019

FIGURE 9 GLOBAL MARKET, BY TECHNOLOGY, 2020 VS. 2025 (USD MILLION)

FIGURE 10 GLOBAL MICROBIAL IDENTIFICATION INDUSTRY, BY APPLICATION, 2020 VS. 2025 (USD MILLION)

FIGURE 11 GLOBAL MARKET, BY END USER, 2020?2025

FIGURE 12 GEOGRAPHICAL SNAPSHOT OF THE GLOBAL MICROBIAL IDENTIFICATION INDUSTRY

4 PREMIUM INSIGHTS (Page No. - 54)

4.1 GLOBAL MARKET OVERVIEW

FIGURE 13 RISING INCIDENCE OF INFECTIOUS DISEASES TO DRIVE MARKET GROWTH

4.2 ASIA PACIFIC: MARKET, BY END USER & COUNTRY (2019)

FIGURE 14 HOSPITALS, DIAGNOSTIC LABORATORIES, AND BLOOD BANKS ACCOUNTED FOR THE LARGEST SHARE OF THE ASIA PACIFIC MARKET IN 2019

4.3 MICROBIAL IDENTIFICATION CONSUMABLES MARKET, BY TYPE

FIGURE 15 PANELS/ID CARDS & MEDIA ARE PROJECTED TO WITNESS THE HIGHEST GROWTH IN THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 57)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 MICROBIAL IDENTIFICATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, CHALLENGES, AND TRENDS

5.2.1 DRIVERS

5.2.1.1 Rising incidence of infectious diseases and increasing frequency of pandemics

5.2.1.2 Technological advancements

5.2.1.3 Increasing food safety concerns

5.2.1.4 Increasing government initiatives and funding to detect and control antimicrobial-resistant species

5.2.2 RESTRAINTS

5.2.2.1 High cost of automated microbial identification systems

5.2.3 OPPORTUNITIES

5.2.3.1 Emerging economies present significant growth opportunities

5.2.3.2 Bioterrorism surveillance

5.2.4 CHALLENGES

5.2.4.1 Complex regulatory frameworks that delay the approval of new microbial diagnostic tests

5.2.5 TRENDS

5.2.5.1 Impact of COVID-19 on the global market

5.3 TECHNOLOGICAL ANALYSIS

5.3.1 CONVENTIONAL METHODS

5.3.2 MODERN METHODS

TABLE 1 BROAD CLASSIFICATION OF THE VARIOUS METHODS OF MICROBIAL IDENTIFICATION

TABLE 2 COMPARISON OF TIME-TO-DETECTION OF IDENTIFICATION SYSTEMS

5.4 REGULATORY ANALYSIS

5.5 ECOSYSTEM ANALYSIS OF THE GLOBAL MARKET

FIGURE 17 ECOSYSTEM ANALYSIS OF THE GLOBAL MARKET

5.6 VALUE CHAIN ANALYSIS

FIGURE 18 VALUE CHAIN ANALYSIS-MAXIMUM VALUE IS ADDED DURING THE MANUFACTURING PHASE

6 MICROBIAL IDENTIFICATION MARKET, BY PRODUCT & SERVICE (Page No. - 68)

6.1 INTRODUCTION

TABLE 3 GLOBAL MICROBIAL IDENTIFICATION INDUSTRY, BY PRODUCT & SERVICE, 2018-2025 (USD MILLION)

6.1.1 INSTRUMENTS & SOFTWARE

6.1.1.1 Technological advancements in microbial identification systems to drive the market for instruments & software

TABLE 4 MICROBIAL IDENTIFICATION INSTRUMENTS & SOFTWARE MARKET, BY REGION, 2018-2025 (USD MILLION)

TABLE 5 NORTH AMERICA: MICROBIAL IDENTIFICATION INSTRUMENTS & SOFTWARE MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 6 EUROPE: MICROBIAL IDENTIFICATION INSTRUMENTS & SOFTWARE MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 7 APAC: MICROBIAL IDENTIFICATION INSTRUMENTS & SOFTWARE MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

6.1.2 CONSUMABLES

TABLE 8 MICROBIAL IDENTIFICATION CONSUMABLES MARKET, BY REGION, 2018-2025 (USD MILLION)

TABLE 9 NORTH AMERICA: MICROBIAL IDENTIFICATION CONSUMABLES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 10 EUROPE: MICROBIAL IDENTIFICATION CONSUMABLES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 11 APAC: MARKET CONSUMABLES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 12 MICROBIAL IDENTIFICATION CONSUMABLES MARKET, BY TYPE, 2018-2025 (USD MILLION)

6.1.2.1 Panels/ID Cards & MEDIA

6.1.2.1.1 Panels, ID cards, and media enable the easy and rapid identification of microorganisms-key factors driving market growth

TABLE 13 MICROBIAL IDENTIFICATION PANELS/ID CARDS & MEDIA MARKET, BY REGION, 2018-2025 (USD MILLION)

TABLE 14 NORTH AMERICA: MICROBIAL IDENTIFICATION PANELS/ID CARDS & MEDIA MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 15 EUROPE: MICROBIAL IDENTIFICATION PANELS/ID CARDS & MEDIA MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 16 APAC: MICROBIAL IDENTIFICATION PANELS/ID CARDS & MEDIA MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

6.1.2.2 KITS

6.1.2.2.1 Kits are user-friendly methods that enable the rapid detection and identification of microorganisms

TABLE 17 MICROBIAL IDENTIFICATION KITS MARKET, BY REGION, 2018-2025 (USD MILLION)

TABLE 18 NORTH AMERICA: MICROBIAL IDENTIFICATION KITS MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 19 EUROPE: MICROBIAL IDENTIFICATION KITS MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 20 APAC: MICROBIAL IDENTIFICATION KITS MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

6.1.2.3 OTHER CONSUMABLES

TABLE 21 OTHER MICROBIAL IDENTIFICATION CONSUMABLES MARKET, BY REGION, 2018-2025 (USD MILLION)

TABLE 22 NORTH AMERICA: OTHER MICROBIAL IDENTIFICATION CONSUMABLES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 23 EUROPE: OTHER MICROBIAL IDENTIFICATION CONSUMABLES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 24 APAC: OTHER MICROBIAL IDENTIFICATION CONSUMABLES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

6.1.3 SERVICES

TABLE 25 MICROBIAL IDENTIFICATION SERVICES MARKET, BY REGION, 2018-2025 (USD MILLION)

TABLE 26 NORTH AMERICA: MICROBIAL IDENTIFICATION SERVICES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 27 EUROPE: MICROBIAL IDENTIFICATION SERVICES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 28 APAC: MICROBIAL IDENTIFICATION SERVICES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7 MICROBIAL IDENTIFICATION MARKET, BY METHOD (Page No. - 80)

7.1 INTRODUCTION

TABLE 29 GLOBAL MICROBIAL IDENTIFICATION INDUSTRY, BY METHOD, 2018-2025 (USD MILLION)

7.1.1 PHENOTYPIC METHODS

7.1.1.1 Ease of use and cost-effectiveness of phenotypic tests are key factors driving market growth

TABLE 30 GLOBAL MARKET FOR PHENOTYPIC METHODS, BY REGION, 2018-2025 (USD MILLION)

TABLE 31 NORTH AMERICA: MARKET FOR PHENOTYPIC METHODS, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 32 EUROPE: MARKET FOR PHENOTYPIC METHODS, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 33 APAC: MARKET FOR PHENOTYPIC METHODS, BY COUNTRY, 2018-2025 (USD MILLION)

7.1.2 PROTEOMICS-BASED METHODS

7.1.2.1 Growing adoption of proteomics-based methods such as mass spectrometry to drive growth in this market segment

TABLE 34 GLOBAL MARKET FOR PROTEOMICS-BASED METHODS, BY REGION, 2018-2025 (USD MILLION)

TABLE 35 NORTH AMERICA: MARKET FOR PROTEOMICS-BASED METHODS, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 36 EUROPE: MARKET FOR PROTEOMICS-BASED METHODS, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 37 APAC: MARKET FOR PROTEOMICS-BASED METHODS, BY COUNTRY, 2018-2025 (USD MILLION)

7.1.3 GENOTYPIC METHODS

7.1.3.1 High level of sensitivity and accuracy of genotypic methods to fuel market growth

TABLE 38 GLOBAL MARKET FOR GENOTYPIC METHODS, BY REGION, 2018-2025 (USD MILLION)

TABLE 39 NORTH AMERICA: MARKET FOR GENOTYPIC METHODS, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 40 EUROPE: MARKET FOR GENOTYPIC METHODS, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 41 APAC: MARKET FOR GENOTYPIC METHODS, BY COUNTRY, 2018-2025 (USD MILLION)

8 MICROBIAL IDENTIFICATION MARKET, BY TECHNOLOGY (Page No. - 88)

8.1 INTRODUCTION

TABLE 42 GLOBAL MICROBIAL IDENTIFICATION INDUSTRY, BY TECHNOLOGY, 2018-2025 (USD MILLION)

8.1.1 MASS SPECTROMETRY-BASED MICROBIAL IDENTIFICATION MARKET

8.1.1.1 Growing adoption of MALDI-TOF for microbial identification to fuel market growth

TABLE 43 MASS SPECTROMETRY-BASED MICROBIAL-IDENTIFICATION MARKET, BY REGION, 2018-2025 (USD MILLION)

TABLE 44 NORTH AMERICA: MASS SPECTROMETRY-BASED MICROBIAL-IDENTIFICATION MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 45 EUROPE: MASS SPECTROMETRY-BASED MICROBIAL-IDENTIFICATION MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 46 APAC: MASS SPECTROMETRY-BASED MICROBIAL-IDENTIFICATION MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

8.1.2 PCR BASED MICROBIAL IDENTIFICATION MARKET

8.1.2.1 High sensitivity and accuracy of PCR techniques to drive market growth

TABLE 47 PCR-BASED MICROBIAL-IDENTIFICATION MARKET, BY REGION, 2018-2025 (USD MILLION)

TABLE 48 NORTH AMERICA: PCR-BASED MICROBIAL-IDENTIFICATION MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 49 EUROPE: PCR-BASED MICROBIAL-IDENTIFICATION MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 50 APAC: PCR-BASED MICROBIAL-IDENTIFICATION MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

8.1.3 FLOW CYTOMETRY BASED MICROBIAL IDENTIFICATION MARKET

8.1.3.1 Flow cytometers enable microbial detection without cell culturing techniques and provide rapid results

TABLE 51 FLOW CYTOMETRY-BASED MICROBIAL-IDENTIFICATION MARKET, BY REGION, 2018-2025 (USD MILLION)

TABLE 52 NORTH AMERICA: FLOW CYTOMETRY-BASED MICROBIAL-IDENTIFICATION MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 53 EUROPE: FLOW CYTOMETRY-BASED MICROBIAL-IDENTIFICATION MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 54 APAC: FLOW CYTOMETRY-BASED MICROBIAL-IDENTIFICATION MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

8.1.4 MICROSCOPY BASED MICROBIAL IDENTIFICATION MARKET

8.1.4.1 Low cost of microscopy instruments to drive growth in this market segment

TABLE 55 MICROSCOPY-BASED MICROBIAL-IDENTIFICATION MARKET, BY REGION, 2018-2025 (USD MILLION)

TABLE 56 NORTH AMERICA: MICROSCOPY-BASED MICROBIAL-IDENTIFICATION MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 57 EUROPE: MICROSCOPY-BASED MICROBIAL-IDENTIFICATION MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 58 APAC: MICROSCOPY-BASED MICROBIAL-IDENTIFICATION MARKET, 2018-2025 (USD MILLION)

8.1.5 OTHER MICROBIAL IDENTIFICATION TECHNOLOGIES

TABLE 59 OTHER MICROBIAL IDENTIFICATION TECHNOLOGIES MARKET, BY REGION, 2018-2025 (USD MILLION)

TABLE 60 NORTH AMERICA: OTHER MICROBIAL IDENTIFICATION TECHNOLOGIES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 61 EUROPE: OTHER MICROBIAL IDENTIFICATION TECHNOLOGIES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 62 APAC: OTHER MICROBIAL IDENTIFICATION TECHNOLOGIES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

9 MICROBIAL IDENTIFICATION MARKET, BY APPLICATION (Page No. - 99)

9.1 INTRODUCTION

TABLE 63 GLOBAL MICROBIAL IDENTIFICATION INDUSTRY, BY APPLICATION, 2018-2025 (USD MILLION)

9.1.1 DIAGNOSTIC APPLICATIONS

TABLE 64 GLOBAL MARKET FOR DIAGNOSTIC APPLICATIONS, BY REGION, 2018-2025 (USD MILLION)

TABLE 65 NORTH AMERICA: MARKET FOR DIAGNOSTIC APPLICATIONS, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 66 EUROPE: MARKET FOR DIAGNOSTIC APPLICATIONS, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 67 APAC: MARKET FOR DIAGNOSTIC APPLICATIONS, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 68 GLOBAL MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2018-2025 (USD MILLION)

9.1.1.1 Human disease diagnosis

9.1.1.1.1 High prevalence of infectious diseases, coupled with periodic outbreaks of pandemics, is fueling the market growth

TABLE 69 GLOBAL MARKET FOR HUMAN DISEASE DIAGNOSIS, BY REGION, 2018-2025 (USD MILLION)

TABLE 70 NORTH AMERICA: MARKET FOR HUMAN DISEASE DIAGNOSIS, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 71 EUROPE: MARKET FOR HUMAN DISEASE DIAGNOSIS, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 72 APAC: MARKET FOR HUMAN DISEASE DIAGNOSIS, BY COUNTRY, 2018-2025 (USD MILLION)

9.1.1.2 Animal disease diagnosis

9.1.1.2.1 Increasing legislation changes for improving animal welfare in various countries across the globe to drive market growth

TABLE 73 GLOBAL MARKET FOR ANIMAL DISEASE DIAGNOSIS, BY REGION, 2018-2025 (USD MILLION)

TABLE 74 NORTH AMERICA: MARKET FOR ANIMAL DISEASE DIAGNOSIS, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 75 EUROPE: MARKET FOR ANIMAL DISEASE DIAGNOSIS, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 76 APAC: MARKET FOR ANIMAL DISEASE DIAGNOSIS, BY COUNTRY, 2018-2025 (USD MILLION)

9.1.2 PHARMACEUTICAL APPLICATIONS

9.1.2.1 Microbial identification techniques are used widely for contamination detection in pharmaceutical products

TABLE 77 GLOBAL MARKET FOR PHARMACEUTICAL APPLICATIONS, BY REGION, 2018-2025 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET FOR PHARMACEUTICAL APPLICATIONS, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 79 EUROPE: MARKET FOR PHARMACEUTICAL APPLICATIONS, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 80 APAC: MARKET FOR PHARMACEUTICAL APPLICATIONS, BY COUNTRY, 2018-2025 (USD MILLION)

9.1.3 FOOD TESTING

9.1.3.1 Increasing adoption of microbial identification technologies to detect contaminants in food products to boost the market

TABLE 81 GLOBAL MARKET FOR FOOD TESTING, BY REGION, 2018-2025 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET FOR FOOD TESTING, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 83 EUROPE: MARKET FOR FOOD TESTING, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 84 APAC: MARKET FOR FOOD TESTING, BY COUNTRY, 2018-2025 (USD MILLION)

9.1.4 BEVERAGE TESTING

9.1.4.1 Microbial identification techniques are widely used to maintain high levels of hygiene and quality in beverages

TABLE 85 GLOBAL MARKET FOR BEVERAGE TESTING, BY REGION, 2018-2025 (USD MILLION)

TABLE 86 NORTH AMERICA: MARKET FOR BEVERAGE TESTING, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 87 EUROPE: MARKET FOR BEVERAGE TESTING, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 88 APAC: MARKET FOR BEVERAGE TESTING, BY COUNTRY, 2018-2025 (USD MILLION)

9.1.5 COSMETICS AND PERSONAL CARE PRODUCTS TESTING

9.1.5.1 Microbial identification is widely used to determine the presence of microbes in the cosmetic manufacturing process

TABLE 89 GLOBAL MARKET FOR COSMETICS AND PERSONAL CARE PRODUCTS TESTING, BY REGION, 2018-2025 (USD MILLION)

TABLE 90 NORTH AMERICA: MARKET FOR COSMETICS AND PERSONAL CARE PRODUCTS TESTING, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 91 EUROPE: MARKET FOR COSMETICS AND PERSONAL CARE PRODUCTS TESTING, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 92 APAC: MARKET FOR COSMETICS AND PERSONAL CARE PRODUCTS TESTING, BY COUNTRY, 2018-2025 (USD MILLION)

9.1.6 ENVIRONMENTAL APPLICATIONS

9.1.6.1 Growing focus on environmental monitoring across the globe is one of the major factors driving the growth of this market

TABLE 93 GLOBAL MARKET FOR ENVIRONMENTAL APPLICATIONS, BY REGION, 2018-2025 (USD MILLION)

TABLE 94 NORTH AMERICA: MARKET FOR ENVIRONMENTAL APPLICATIONS, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 95 EUROPE: MARKET FOR ENVIRONMENTAL APPLICATIONS, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 96 APAC: MARKET FOR ENVIRONMENTAL APPLICATIONS, BY COUNTRY, 2018-2025 (USD MILLION)

9.1.7 OTHER APPLICATIONS

TABLE 97 GLOBAL MARKET FOR OTHER APPLICATIONS, BY REGION, 2018-2025 (USD MILLION)

TABLE 98 NORTH AMERICA: MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 99 EUROPE: MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 100 APAC: MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2018-2025 (USD MILLION)

10 MICROBIAL IDENTIFICATION MARKET, BY END USER (Page No. - 117)

10.1 INTRODUCTION

TABLE 101 GLOBAL MICROBIAL IDENTIFICATION INDUSTRY, BY END USER, 2018-2025 (USD MILLION)

10.1.1 HOSPITALS, DIAGNOSTIC LABORATORIES, AND BLOOD BANKS

10.1.1.1 Extensive usage of microbial identification techniques for infectious disease diagnosis to drive market growth

TABLE 102 GLOBAL MARKET FOR HOSPITALS, DIAGNOSTIC LABORATORIES, AND BLOOD BANKS, BY REGION, 2018-2025 (USD MILLION)

TABLE 103 NORTH AMERICA: MARKET FOR HOSPITALS, DIAGNOSTIC LABORATORIES, AND BLOOD BANKS, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 104 EUROPE: MARKET FOR HOSPITALS, DIAGNOSTIC LABORATORIES, AND BLOOD BANKS, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 105 APAC: MARKET FOR HOSPITALS, DIAGNOSTIC LABORATORIES, AND BLOOD BANKS, BY COUNTRY, 2018-2025 (USD MILLION)

10.1.2 PHARMACEUTICAL COMPANIES & CONTRACT RESEARCH ORGANIZATIONS

10.1.2.1 Increasing use of microbial identification techniques to maintain regulatory compliance is boosting the growth of this market

TABLE 106 GLOBAL MARKET FOR PHARMACEUTICAL COMPANIES & CONTRACT RESEARCH ORGANIZATIONS, BY REGION, 2018-2025 (USD MILLION)

TABLE 107 NORTH AMERICA: MARKET FOR PHARMACEUTICAL COMPANIES & CONTRACT RESEARCH ORGANIZATIONS, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 108 EUROPE: MARKET FOR PHARMACEUTICAL COMPANIES & CONTRACT RESEARCH ORGANIZATIONS, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 109 APAC: MARKET FOR PHARMACEUTICAL COMPANIES & CONTRACT RESEARCH ORGANIZATIONS, BY COUNTRY, 2018-2025 (USD MILLION)

10.1.3 FOOD MANUFACTURING COMPANIES

10.1.3.1 Growing number of regulations related to the quality of food manufacturing to drive market growth

TABLE 110 GLOBAL MARKET FOR FOOD MANUFACTURING COMPANIES, BY REGION, 2018-2025 (USD MILLION)

TABLE 111 NORTH AMERICA: MARKET FOR FOOD MANUFACTURING COMPANIES, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 112 EUROPE: MARKET FOR FOOD MANUFACTURING COMPANIES, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 113 APAC: MARKET FOR FOOD MANUFACTURING COMPANIES, BY COUNTRY, 2018-2025 (USD MILLION)

10.1.4 BEVERAGE MANUFACTURING COMPANIES

10.1.4.1 Microbial identification techniques are widely used to maintain the safety and quality of beverages

TABLE 114 GLOBAL MARKET FOR BEVERAGE MANUFACTURING COMPANIES, BY REGION, 2018-2025 (USD MILLION)

TABLE 115 NORTH AMERICA: MARKET FOR BEVERAGE MANUFACTURING COMPANIES, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 116 EUROPE: MARKET FOR BEVERAGE MANUFACTURING COMPANIES, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 117 APAC: MARKET FOR BEVERAGE MANUFACTURING COMPANIES, BY COUNTRY, 2018-2025 (USD MILLION)

10.1.5 OTHER END USERS

TABLE 118 GLOBAL MARKET FOR OTHER END USERS, BY REGION, 2018-2025 (USD MILLION)

TABLE 119 NORTH AMERICA: MARKET FOR OTHER END USERS, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 120 EUROPE: MARKET OTHER END USERS, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 121 APAC: MARKET FOR OTHER END USERS, BY COUNTRY, 2018-2025 (USD MILLION)

11 MICROBIAL IDENTIFICATION MARKET, BY REGION (Page No. - 128)

11.1 INTRODUCTION

TABLE 122 GLOBAL MICROBIAL IDENTIFICATION INDUSTRY, BY REGION, 2018-2025 (USD MILLION)

11.2 NORTH AMERICA

FIGURE 19 NORTH AMERICA: MICROBIAL IDENTIFICATION MARKET SNAPSHOT

TABLE 123 NORTH AMERICA: MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 124 NORTH AMERICA: MARKET, BY PRODUCT & SERVICE, 2018-2025 (USD MILLION)

TABLE 125 NORTH AMERICA: MICROBIAL IDENTIFICATION CONSUMABLES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 126 NORTH AMERICA: MARKET, BY METHOD, 2018-2025 (USD MILLION)

TABLE 127 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2018-2025 (USD MILLION)

TABLE 128 NORTH AMERICA: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 129 NORTH AMERICA: MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2018-2025 (USD MILLION)

TABLE 130 NORTH AMERICA: MICROBIAL IDENTIFICATION INDUSTRY, BY END USER, 2018-2025 (USD MILLION)

11.2.1 US

11.2.1.1 The US is the largest country-level market for microbial identification

TABLE 131 US: MICROBIAL IDENTIFICATION MARKET, BY PRODUCT & SERVICE, 2018-2025 (USD MILLION)

TABLE 132 US: MICROBIAL IDENTIFICATION CONSUMABLES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 133 US: MARKET, BY METHOD, 2018-2025 (USD MILLION)

TABLE 134 US: MARK, BY TECHNOLOGY, 2018-2025 (USD MILLION)

TABLE 135 US: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 136 US: MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2018-2025 (USD MILLION)

TABLE 137 US: MICROBIAL IDENTIFICATION INDUSTRY, BY END USER, 2018-2025 (USD MILLION)

11.2.2 CANADA

11.2.2.1 Rising incidence of infectious diseases along with strong government funding to drive the market

TABLE 138 CANADA: MICROBIAL IDENTIFICATION MARKET, BY PRODUCT & SERVICE, 2018-2025 (USD MILLION)

TABLE 139 CANADA: MICROBIAL IDENTIFICATION CONSUMABLES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 140 CANADA: MARKET, BY METHOD, 2018-2025 (USD MILLION)

TABLE 141 CANADA: MARKET, BY TECHNOLOGY, 2018-2025 (USD MILLION)

TABLE 142 CANADA: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 143 CANADA: MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2018-2025 (USD MILLION)

TABLE 144 CANADA: MICROBIAL IDENTIFICATION INDUSTRY, BY END USER, 2018-2025 (USD MILLION)

11.3 EUROPE

TABLE 145 EUROPE: MICROBIAL IDENTIFICATION MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 146 EUROPE: MARKET, BY PRODUCT & SERVICE, 2018-2025 (USD MILLION)

TABLE 147 EUROPE: MICROBIAL IDENTIFICATION CONSUMABLES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 148 EUROPE: MARKET, BY METHOD, 2018-2025 (USD MILLION)

TABLE 149 EUROPE: MARKET, BY TECHNOLOGY, 2018-2025 (USD MILLION)

TABLE 150 EUROPE: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 151 EUROPE: MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2018-2025 (USD MILLION)

TABLE 152 EUROPE: MICROBIAL IDENTIFICATION INDUSTRY, BY END USER, 2018-2025 (USD MILLION)

11.3.1 GERMANY

11.3.1.1 Germany to dominate the European microbial identification market

TABLE 153 GERMANY: MARKET, BY PRODUCT & SERVICE, 2018-2025 (USD MILLION)

TABLE 154 GERMANY: MICROBIAL IDENTIFICATION CONSUMABLES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 155 GERMANY: MARKET, BY METHOD, 2018-2025 (USD MILLION)

TABLE 156 GERMANY: MARKET, BY TECHNOLOGY, 2018-2025 (USD MILLION)

TABLE 157 GERMANY: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 158 GERMANY: MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2018-2025 (USD MILLION)

TABLE 159 GERMANY: MICROBIAL IDENTIFICATION INDUSTRY, BY END USER, 2018-2025 (USD MILLION)

11.3.2 FRANCE

11.3.2.1 Supportive government policies and easy access to healthcare services to fuel the market

TABLE 160 FRANCE: MICROBIAL IDENTIFICATION MARKET, BY PRODUCT & SERVICE, 2018-2025 (USD MILLION)

TABLE 161 FRANCE: MICROBIAL IDENTIFICATION CONSUMABLES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 162 FRANCE: MARKET, BY METHOD, 2018-2025 (USD MILLION)

TABLE 163 FRANCE: MARKET, BY TECHNOLOGY, 2018-2025 (USD MILLION)

TABLE 164 FRANCE: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 165 FRANCE: MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2018-2025 (USD MILLION)

TABLE 166 FRANCE: MICROBIAL IDENTIFICATION INDUSTRY, BY END USER, 2018-2025 (USD MILLION)

11.3.3 UK

11.3.3.1 High prevalence of infectious diseases is driving the microbial identification market in the UK

TABLE 167 UK: MARKET, BY PRODUCT & SERVICE, 2018-2025 (USD MILLION)

TABLE 168 UK: MICROBIAL IDENTIFICATION CONSUMABLES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 169 UK: MARKET, BY METHOD, 2018-2025 (USD MILLION)

TABLE 170 UK: MARKET, BY TECHNOLOGY, 2018-2025 (USD MILLION)

TABLE 171 UK: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 172 UK: MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2018-2025 (USD MILLION)

TABLE 173 UK: MICROBIAL IDENTIFICATION INDUSTRY, BY END USER, 2018-2025 (USD MILLION)

11.3.4 REST OF EUROPE (ROE

TABLE 174 ROE: MICROBIAL IDENTIFICATION MARKET, BY PRODUCT & SERVICE, 2018-2025 (USD MILLION)

TABLE 175 ROE: MICROBIAL IDENTIFICATION CONSUMABLES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 176 ROE: MARKET, BY METHOD, 2018-2025 (USD MILLION)

TABLE 177 ROE: MARKET, BY TECHNOLOGY, 2018-2025 (USD MILLION)

TABLE 178 ROE: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 179 ROE: MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2018-2025 (USD MILLION)

TABLE 180 ROE: MICROBIAL IDENTIFICATION INDUSTRY, BY END USER, 2018-2025 (USD MILLION)

11.4 ASIA PACIFIC

FIGURE 20 ASIA PACIFIC: MICROBIAL IDENTIFICATION MARKET SNAPSHOT

TABLE 181 APAC: MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 182 APAC: MARKET, BY PRODUCT & SERVICE, 2018-2025 (USD MILLION)

TABLE 183 APAC: MICROBIAL IDENTIFICATION CONSUMABLES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 184 APAC: MARKET, BY METHOD, 2018-2025 (USD MILLION)

TABLE 185 APAC: MARKET, BY TECHNOLOGY, 2018-2025 (USD MILLION)

TABLE 186 APAC: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 187 APAC: MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2018-2025 (USD MILLION)

TABLE 188 APAC: MICROBIAL IDENTIFICATION INDUSTRY, BY END USER, 2018-2025 (USD MILLION)

11.4.1 JAPAN

11.4.1.1 Japan dominates the APAC market for microbial identification

TABLE 189 JAPAN: MICROBIAL IDENTIFICATION MARKET, BY PRODUCT & SERVICE, 2018-2025 (USD MILLION)

TABLE 190 JAPAN: MICROBIAL IDENTIFICATION CONSUMABLES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 191 JAPAN: MARKET, BY METHOD, 2018-2025 (USD MILLION)

TABLE 192 JAPAN: MARKET, BY TECHNOLOGY, 2018-2025 (USD MILLION)

TABLE 193 JAPAN: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 194 JAPAN: MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2018-2025 (USD MILLION)

TABLE 195 JAPAN: MICROBIAL IDENTIFICATION INDUSTRY, BY END USER, 2018-2025 (USD MILLION)

11.4.2 CHINA

11.4.2.1 Favorable regulations and heavy infectious disease burden to drive the growth of the microbial identification market in China

TABLE 196 CHINA: MARKET, BY PRODUCT & SERVICE, 2018-2025 (USD MILLION)

TABLE 197 CHINA: MICROBIAL IDENTIFICATION CONSUMABLES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 198 CHINA: MARKET, BY METHOD, 2018-2025 (USD MILLION)

TABLE 199 CHINA: MARKET, BY TECHNOLOGY, 2018-2025 (USD MILLION)

TABLE 200 CHINA: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 201 CHINA: MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2018-2025 (USD MILLION)

TABLE 202 CHINA: MICROBIAL IDENTIFICATION INDUSTRY, BY END USER, 2018-2025 (USD MILLION)

11.4.3 INDIA

11.4.3.1 Growing initiatives for clinical diagnosis and food safety by the government and major players to drive the market

TABLE 203 INDIA: MICROBIAL IDENTIFICATION MARKET, BY PRODUCT & SERVICE, 2018-2025 (USD MILLION)

TABLE 204 INDIA: MICROBIAL IDENTIFICATION CONSUMABLES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 205 INDIA: MARKET, BY METHOD, 2018-2025 (USD MILLION)

TABLE 206 INDIA: MARKET, BY TECHNOLOGY, 2018-2025 (USD MILLION)

TABLE 207 INDIA: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 208 INDIA: MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2018-2025 (USD MILLION)

TABLE 209 INDIA: MICROBIAL IDENTIFICATION INDUSTRY, BY END USER, 2018-2025 (USD MILLION)

11.4.4 SOUTH KOREA

11.4.4.1 Growing research supported by national institutes has led to rising adoption of microbial identification technologies

TABLE 210 SOUTH KOREA: MICROBIAL IDENTIFICATION MARKET, BY PRODUCT & SERVICE, 2018-2025 (USD MILLION)

TABLE 211 SOUTH KOREA: MICROBIAL IDENTIFICATION CONSUMABLES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 212 SOUTH KOREA: MARKET, BY METHOD, 2018-2025 (USD MILLION)

TABLE 213 SOUTH KOREA: MARKET, BY TECHNOLOGY, 2018-2025 (USD MILLION)

TABLE 214 SOUTH KOREA: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 215 SOUTH KOREA: MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2018-2025 (USD MILLION)

TABLE 216 SOUTH KOREA: MICROBIAL IDENTIFICATION INDUSTRY, BY END USER, 2018-2025 (USD MILLION)

11.4.5 REST OF ASIA PACIFIC (ROAPAC

TABLE 217 ROAPAC: MICROBIAL IDENTIFICATION MARKET, BY PRODUCT & SERVICE, 2018-2025 (USD MILLION)

TABLE 218 ROAPAC: MICROBIAL IDENTIFICATION CONSUMABLES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 219 ROAPAC: MARKET, BY METHOD, 2018-2025 (USD MILLION)

TABLE 220 ROAPAC: MARKET, BY TECHNOLOGY, 2018-2025 (USD MILLION)

TABLE 221 ROAPAC: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 222 ROAPAC: MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2018-2025 (USD MILLION)

TABLE 223 ROAPAC: MICROBIAL IDENTIFICATION INDUSTRY, BY END USER, 2018-2025 (USD MILLION)

11.5 REST OF THE WORLD

TABLE 224 ROW: MICROBIAL IDENTIFICATION MARKET, BY REGION, 2018-2025 (USD MILLION)

TABLE 225 ROW: MARKET, BY PRODUCT & SERVICE, 2018-2025 (USD MILLION)

TABLE 226 ROW: MICROBIAL IDENTIFICATION CONSUMABLES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 227 ROW: MARKET, BY METHOD, 2018-2025 (USD MILLION)

TABLE 228 ROW: MARKET, BY TECHNOLOGY, 2018-2025 (USD MILLION)

TABLE 229 ROW: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 230 ROW: MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2018-2025 (USD MILLION)

TABLE 231 ROW: MICROBIAL IDENTIFICATION INDUSTRY, BY END USER, 2018-2025 (USD MILLION)

11.5.1 LATIN AMERICA

TABLE 232 LATIN AMERICA: MICROBIAL IDENTIFICATION MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 233 LATIN AMERICA: MARKET, BY PRODUCT & SERVICE, 2018-2025 (USD MILLION)

TABLE 234 LATIN AMERICA: MICROBIAL IDENTIFICATION CONSUMABLES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 235 LATIN AMERICA: MARKET, BY METHOD, 2018-2025 (USD MILLION)

TABLE 236 LATIN AMERICA: MARKET, BY TECHNOLOGY, 2018-2025 (USD MILLION)

TABLE 237 LATIN AMERICA: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 238 LATIN AMERICA: MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2018-2025 (USD MILLION)

TABLE 239 LATIN AMERICA: MARKET, BY END USER, 2018-2025 (USD MILLION)

11.5.1.1 Brazil

11.5.1.1.1 Growing number of research projects using different microbial identification techniques to drive market growth

TABLE 240 BRAZIL: MICROBIAL IDENTIFICATION MARKET, BY PRODUCT & SERVICE, 2018-2025 (USD MILLION)

TABLE 241 BRAZIL: MICROBIAL IDENTIFICATION CONSUMABLES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 242 BRAZIL: MARKET, BY METHOD, 2018-2025 (USD MILLION)

TABLE 243 BRAZIL: MARKET, BY TECHNOLOGY, 2018-2025 (USD MILLION)

TABLE 244 BRAZIL: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 245 BRAZIL: MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2018-2025 (USD MILLION)

TABLE 246 BRAZIL: MARKET, BY END USER, 2018-2025 (USD MILLION)

11.5.1.2 REST OF LATIN AMERICA

TABLE 247 REST OF LATIN AMERICA: MICROBIAL IDENTIFICATION MARKET, BY PRODUCT & SERVICE, 2018-2025 (USD MILLION)

TABLE 248 REST OF LATIN AMERICA: MICROBIAL IDENTIFICATION CONSUMABLES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 249 REST OF LATIN AMERICA: MARKET, BY METHOD, 2018-2025 (USD MILLION)

TABLE 250 REST OF LATIN AMERICA: MARKET, BY TECHNOLOGY, 2018-2025 (USD MILLION)

TABLE 251 REST OF LATIN AMERICA: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 252 REST OF LATIN AMERICA: MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2018-2025 (USD MILLION)

TABLE 253 REST OF LATIN AMERICA: MARKET, BY END USER, 2018-2025 (USD MILLION)

11.5.2 MIDDLE EAST & AFRICA

11.5.2.1 Presence of a large patient population base and growing incidence of infectious diseases to drive the market

TABLE 254 MEA: MICROBIAL IDENTIFICATION MARKET, BY PRODUCT & SERVICE, 2018-2025 (USD MILLION)

TABLE 255 MEA: MICROBIAL IDENTIFICATION CONSUMABLES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 256 MEA: MARKET, BY METHOD, 2018-2025 (USD MILLION)

TABLE 257 MEA: MARKET, BY TECHNOLOGY, 2018-2025 (USD MILLION)

TABLE 258 MEA: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 259 MEA: MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2018-2025 (USD MILLION)

TABLE 260 MEA: MARKET, BY END USER, 2018-2025 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 186)

12.1 INTRODUCTION

12.2 MARKET RANKING ANALYSIS

FIGURE 21 COMPANY RANKING IN THE MICROBIAL IDENTIFICATION MARKET, 2019

12.3 MARKET REVENUE ANALYSIS

FIGURE 22 REVENUE ANALYSIS OF MAJOR PLAYERS (2015-2019)

12.4 MARKET EVALUATION FRAMEWORK

TABLE 261 MARKET EVALUATION FRAMEWORK: PRODUCT LAUNCHES -THE MAJOR STRATEGY ADOPTED BY PLAYERS

12.5 COMPETITIVE SCENARIO

12.5.1 KEY PRODUCT LAUNCHES

12.5.2 KEY COLLABORATIONS, PARTNERSHIPS, AND AGREEMENTS

12.5.3 KEY EXPANSIONS

12.5.4 KEY ACQUISITIONS

13 COMPANY EVALUATION MATRIX AND COMPANY PROFILES (Page No. - 189)

13.1 OVERVIEW

13.2 GLOBAL MICROBIAL IDENTIFICATION MARKET: COMPANY EVALUATION MATRIX

13.2.1 STARS

13.2.2 EMERGING LEADERS

13.2.3 PERVASIVE PLAYERS

13.2.4 PARTICIPANTS

FIGURE 23 GLOBAL MARKET: COMPANY EVALUATION MATRIX, 2019

13.3 COMPANY PROFILES

(Business Overview, Products Offered, Recent Developments, and MnM View)*

13.3.1 BIOMÉRIEUX SA

FIGURE 24 BIOMÉRIEUX SA: COMPANY SNAPSHOT (2019

13.3.2 BECTON, DICKINSON AND COMPANY

FIGURE 25 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT (2019

13.3.3 THERMO FISHER SCIENTIFIC INC.

FIGURE 26 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT (2019)

13.3.4 DANAHER CORPORATION

FIGURE 27 DANAHER CORPORATION: COMPANY SNAPSHOT (2019)

13.3.5 MERCK KGAA

FIGURE 28 MERCK KGAA: COMPANY SNAPSHOT (2019)

13.3.6 BRUKER CORPORATION

FIGURE 29 BRUKER CORPORATION: COMPANY SNAPSHOT (2019)

13.3.7 SHIMADZU CORPORATION

FIGURE 30 SHIMADZU CORPORATION: COMPANY SNAPSHOT (2018)

13.3.8 QIAGEN NV

FIGURE 31 QIAGEN NV: COMPANY SNAPSHOT (2018)

13.3.9 AVANTOR, INC.

FIGURE 32 AVANTOR, INC.: COMPANY SNAPSHOT (2019)

13.3.10 ACCELERATE DIAGNOSTICS, INC.

FIGURE 33 ACCELERATE DIAGNOSTICS, INC.: COMPANY SNAPSHOT (2019)

13.3.11 BIOLOG, INC.

13.3.12 LIOFILCHEM S.R.L.

13.3.13 TRIVITRON HEALTHCARE

13.3.14 GRADIAN DIAGNOSTICS

13.3.15 ALIFAX S.R.L.

13.3.16 HIMEDIA LABORATORIES

13.3.17 I2A SA

13.3.18 ZHUHAI DL BIOTECH CO., LTD.

13.3.19 GENEFLUIDICS, INC.

13.3.20 CREATIVE DIAGNOSTICS

*Details on Business Overview, Products Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 224)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

14.5 AUTHOR DETAILS

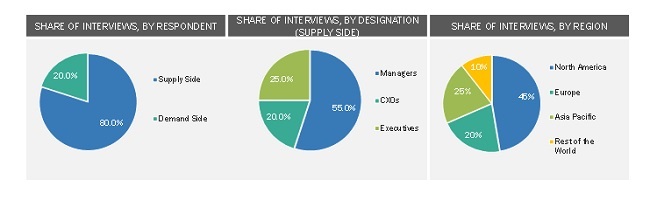

This market research study involved the extensive use of secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and financial study of the global microbial identification market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and to assess market prospects. The size of the global market was estimated through various secondary research approaches and triangulated with inputs from primary research to arrive at the final market size.

Secondary Research

The secondary sources referred to for this research study included publications from government sources such as the World Health Organization (WHO), National Center for Biotechnology Information (NCBI), United Nations Department of Economic and Social Affairs (UN DESA), Centre for Genomic Regulation (CRG), National Institutes of Health (NIH), National Institute of Environmental Health Sciences (NIEHS), Eurostat, Food and Drug Administration (FDA), Centers for Disease Control and Prevention (CDC), International Union of Microbiological Societies (IUMS), European Committee on Antimicrobial Susceptibility Testing (EUCAST), European Society of Clinical Microbiology and Infectious Diseases (ESCMID), European Diagnostic Manufacturers Association (EDMA), American Society for Microbiology (ASM), American Phytopathological Society (APS), American Institute of Biological Sciences (AIBS), American Type Culture Collection (ATCC), National Collection of Type Cultures (NCTC), National Chemical Laboratory (NCL), Journal of Microbiological Methods, and Journal of Clinical Microbiology.

Secondary sources also include corporate and regulatory filings (such as annual reports, SEC filings, investor presentations, and financial statements); business magazines and research journals; press releases; and trade, business, and professional associations, among others. Secondary data was collected and analyzed to arrive at the overall size of the global microbial identification market, which was validated through primary research.

Primary Research

Extensive primary research was conducted after acquiring basic knowledge about the global market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand side (such as personnel from hospitals, diagnostic laboratories, and pharmaceutical companies) and supply side (such as C-level and D-level executives, product managers, marketing and sales managers of key manufacturers, distributors, and channel partners, among others) across four major regions, namely, North America, Europe, the Asia Pacific, and the Rest of the World. Approximately 80% and 20% of primary interviews were conducted with supply-side and demand-side participants, respectively. This primary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews.

BREAKDOWN OF PRIMARY PARTICIPANTS

To know about the assumptions considered for the study, download the pdf brochure

Data Triangulation

After arriving at the overall size of the global microbial identification market through the methodology mentioned above, this market was split into several segments and subsegments. Market breakdown procedures were employed, wherever applicable, to arrive at the exact market value for the key segments and subsegments. The extrapolated market data was triangulated by studying various macroindicators and regional trends from both demand- and supply-side participants.

Report Objectives

- To define, describe, and forecast the microbial identification market based on product & service, method, technology, application, end user, and region

- To provide detailed information regarding the major factors influencing the market growth, such as drivers, restraints, opportunities, challenges, and trends.

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the revenue of the market segments with respect to four main regions, namely, North America, Europe, the Asia Pacific (APAC), and the Rest of the World (RoW)

- To profile the key players in the global market and comprehensively analyze their core competencies and market rankings

- To track and analyze competitive developments, such as product launches, acquisitions, expansions, and partnerships in the microbial identification market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographical Analysis:

- Further breakdown of the European market into RoE countries.

- Further breakdown of the Asia Pacific market into RoAPAC countries.

- Further breakdown of the Rest of the World (RoW) market into Mexico, Argentina, and the RoW countries.

Company Information:

- Detailed analysis and profiling of additional market players (Up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Microbial Identification Market